Under which this service is provided to you.

All content of the Dow Jones branded indices © S&P Dow Jones Indices LLC 2018Ĭable News Network. Standard & Poor's and S&P are registered trademarks of Standard & Poor's Financial Services LLC and Dow Jones is a registered trademark of Dow Jones Trademark Holdings LLC. Dow Jones: The Dow Jones branded indices are proprietary to and are calculated, distributed and marketed by DJI Opco, a subsidiary of S&P Dow Jones Indices LLC and have been licensed for use to S&P Opco, LLC and CNN. Chicago Mercantile Association: Certain market data is the property of Chicago Mercantile Exchange Inc. Market indices are shown in real time, except for the DJIA, which is delayed by two minutes.

"Look at what you are getting over time from the debt." "If you borrowed money on a credit card for a road trip, that might be a good memory, but you should be using debt to acquire an asset or skill that is going to prove to serve you, Beck said. High-interest consumer debt is the "bad" kind. Money borrowed at a relatively low interest rate that helps you grow wealth over the long run - like a mortgage or a student loan - is considered good debt.

#Budget planner for teenager how to#

bad debtĭebt can be a necessary part of adulthood, but parents should teach their children how to distinguish the " good debt" from the bad. Teaching a kid how to read a paycheck can also avoid future head scratching when the first one comes in and it's a lot less than what they expectedĤ. "This shows there isn't an endless amount of money," he said. Show them how much is taken out for taxes, retirement and health insurance, he recommended. It's important to show children the source of the funds that cover all those credit card swipes, bill payments and cash injections, said Van Sant. Have them watch from start to finish: show them your bank account balance, the bill amount and then the pending transaction in your bank account where the payment will come from. Having a child watch you pay bills can also help show the importance of living within your means, said Murset. Related: How to get out of the overspending trap Don't forget to also show the cost of gas and maintenance." "Share the policy and the huge jump in rates for the child compared to the parents. Beck recommended sharing the insurance policy with a teen. But this new freedom comes at a hefty cost to parents.

#Budget planner for teenager license#

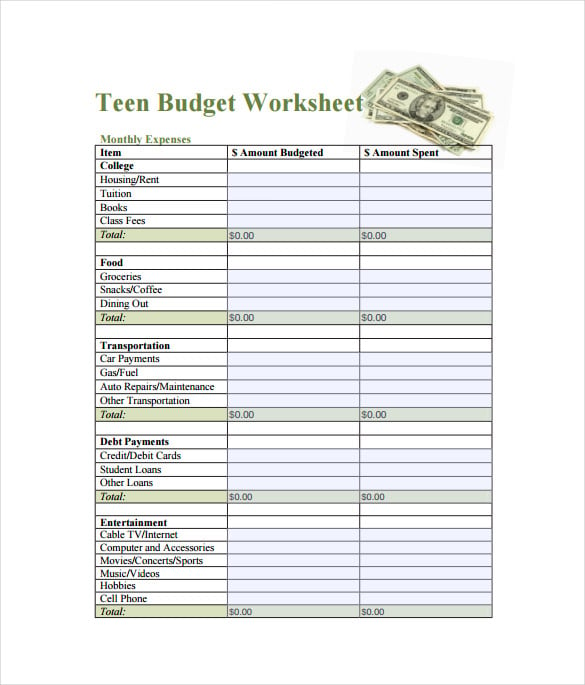

Experts recommend parents take the time to walk teenagers through their financial transactions.įor instance, the 16th birthday milestone is often marked with a driver's license and freedom to hit the road. Our increasingly cash-less society can make it hard for children to understand the true cost of their spending. "When they make the connection that they will need to go shovel more dog poop or take out the trash to get more money to spend, they will make the connection between working and money and not spending other people's money," said Gregg Murset, a CFP and founder of chores app BusyKid. It can also help to have a teenager be responsible for funding part of their lifestyle to help teach the value of money. Related: This is why you need a weekly budget Bonus points if it's based on the teen's wanna-be profession and living location. If they aren't comfortable with divulging their own finances, parents can also create a fictional scenario of an income and living expenses. Parents can also show their children their own budgets. If a teen has a cash flow from a part-time job or an allowance, set up a budget that documents how much money is coming in and how much is designated for savings and spending. "Do it in reasonable sound bites and make it a discussion."Īnd don't forget: While talking about money is important, children are also very observant so parents need to practice what they preach.Įxperts recommended teaching kids how to track their money before they start earning paychecks and the stakes are higher. The first step is to avoid making money talks into lectures, said Ted Beck, CEO of the National Endowment for Financial Education.

0 kommentar(er)

0 kommentar(er)